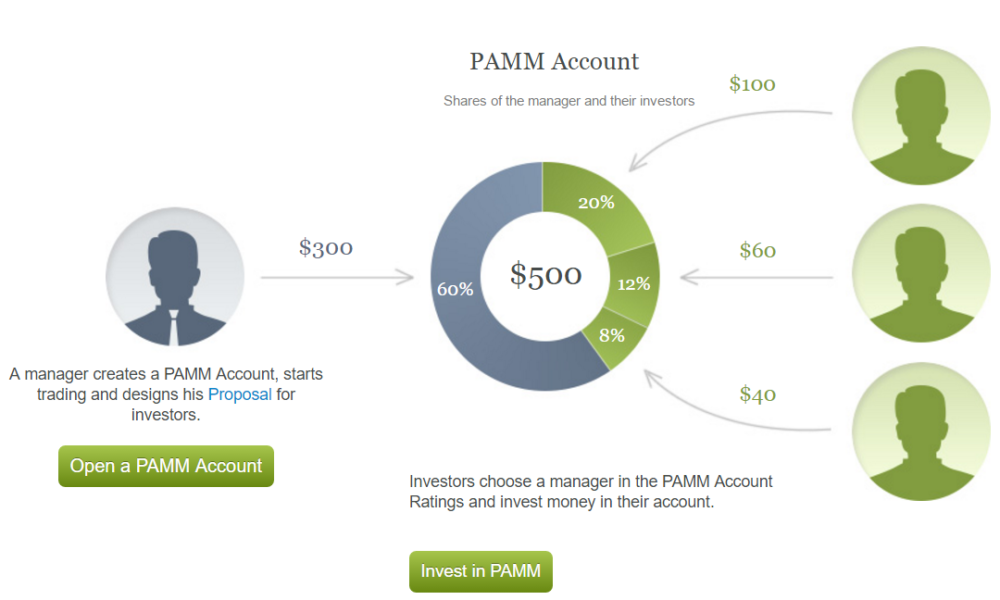

A PAMM (Percentage Allocation Management Module) account is a type of investment account used in forex and other financial markets where funds from multiple investors are pooled together and managed by a professional trader or fund manager. The manager trades on behalf of the investors, and the profits (or losses) from those trades are allocated to each investor based on the proportion of their investment in the pooled fund.

Key Features of a PAMM Account:

- Professional Management: A skilled trader or money manager is responsible for making all the trading decisions. The trader manages the pooled funds, aiming to generate profits.

- Profit Allocation: Investors in a PAMM account share profits and losses based on the percentage of funds they contributed to the account. For example, if an investor contributes 10% of the total pool, they will receive 10% of the profits (or losses) made by the trader.

- Transparency: PAMM account platforms typically provide investors with access to real-time reports, showing the account’s performance, the trades being made, and the balance of their investment.

- Risk Sharing: The risk of loss is distributed across all investors based on their share of the total capital. However, the manager’s own capital is usually also invested in the same account, aligning their interests with the investors.

- No Direct Control: Investors in a PAMM account do not make trading decisions. Instead, they entrust their capital to the professional trader, who executes the trades on their behalf.

- Fee Structure: The manager typically earns a fee, which is either a flat percentage of the profits or a combination of a management fee and a performance fee (usually a percentage of the profits earned).

How a PAMM Account Works:

- Pooling of Funds: Multiple investors deposit money into a single PAMM account. The trader uses this pooled capital to place trades in the forex market or other asset classes.

- Management of Funds: The professional trader handles the day-to-day trading activity based on their strategies, such as technical analysis, fundamental analysis, or a combination of both.

- Profit and Loss Sharing: After trades are executed and profits or losses are generated, the gains or losses are allocated to each investor based on the proportion of their contribution to the total capital in the account.

- Withdrawal: Investors can typically withdraw their funds, subject to certain terms, such as withdrawal limits or timeframes.

Advantages of a PAMM Account:

- Access to Professional Traders: Investors can benefit from the skills of experienced traders.

- Diversification: Pooling funds together allows investors to spread their risk across multiple trades and strategies.

- Transparency: Investors can track the performance of their investments in real-time.

- Passive Investment: Investors don’t need to manage the trades themselves.

- Lower Entry Barriers: Many PAMM accounts allow smaller investments, which makes them accessible to individual investors.