The MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) are both systems used by Forex brokers to allow money managers to manage multiple client accounts from a single platform. While they both serve a similar purpose, they have distinct features and differences that make them suitable for different types of traders and investment structures.

Key Differences Between MAM and PAMM Accounts:

1. Account Management Flexibility:

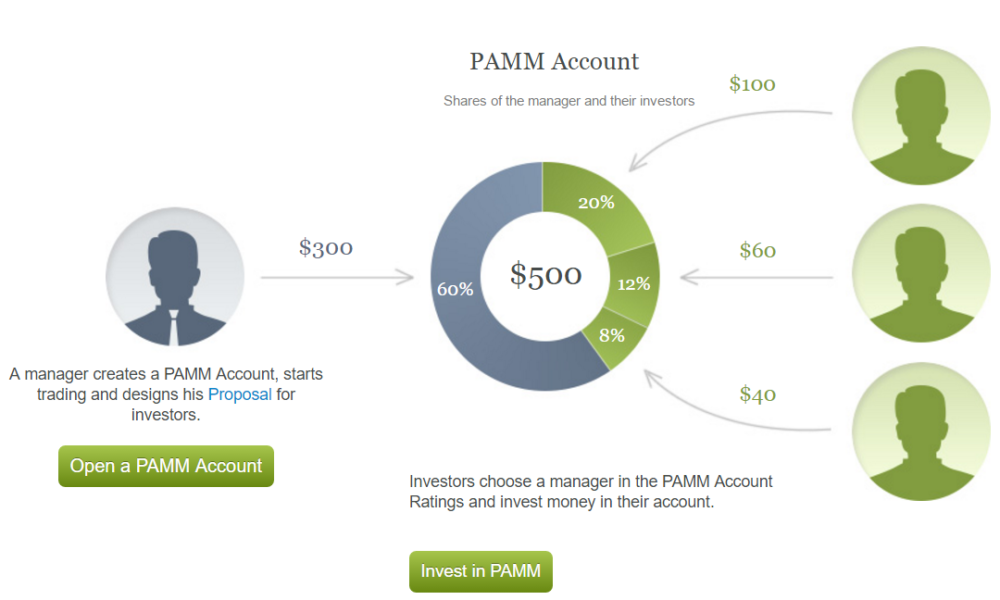

- PAMM: In a PAMM system, all investors’ funds are pooled into a single account, and the money manager trades the pooled funds. The profits or losses from the trades are then allocated to each investor’s account based on their proportion of the pool.

- Example: If an investor contributes 10% of the total PAMM account, they receive 10% of the profits (or losses).

- MAM: A MAM system allows the money manager to trade multiple individual accounts separately but from a single platform. Each account is treated independently, meaning each investor’s trades are handled according to their individual account size and preferences.

- Example: Each investor may have a different risk profile or trade allocation, and trades are distributed based on predefined settings.

2. Trade Allocation:

- PAMM: Trades are executed on a pooled basis, and profits/losses are allocated based on the percentage of the total pool each investor owns. All clients share the same trading positions, and the distribution is automated.

- Allocation is strictly based on the investor’s capital percentage.

- MAM: Trades are allocated individually. The money manager can assign specific lots, risk levels, or positions to each investor’s account, allowing for greater flexibility.

- Each investor can have customized risk profiles or trade sizes, even within the same trading strategy.

3. Risk Management:

- PAMM: Since all investors share the same pool, risk is distributed evenly among investors based on their proportional share of the pool. If the money manager suffers a loss, all investors in the pool share that loss proportionally.

- MAM: Risk management is more customizable. The money manager can apply individual risk settings (e.g., different leverage, lot sizes, or stop-losses) for each investor’s account. Investors can adjust their risk exposure based on personal preferences.

4. Investor Control:

- PAMM: Investors cannot control individual trades; they only have visibility over their share of the overall account’s performance. They cannot modify the positions once they invest.

- MAM: Investors still cannot control the trades directly, but they may have more control over their risk parameters and the allocation of funds within their own accounts. The manager can adjust parameters, but investors may have input into how their funds are managed.

5. Profit Distribution:

- PAMM: Profit is distributed according to the percentage of total capital in the account. The manager typically receives a performance fee based on profits generated.

- Example: If the manager makes a 10% profit and the investor contributed 20% of the total funds, they receive 20% of that 10% profit.

- MAM: Profits are distributed on a per-account basis, based on the amount of capital invested in each account. The manager also takes a percentage of the profits as a performance fee. The structure can be customizable to meet the needs of individual investors.

6. Account Types:

- PAMM: Typically, a single master account is used to manage the pooled funds, and this account is traded by the money manager. The system is simpler, and all investors share the same trading conditions and positions.

- MAM: A multi-account system where each investor has an individual account. The money manager can manage multiple client accounts, but each account is handled independently. MAM systems offer more flexibility, with separate trading strategies applied to each investor’s account.

7. Investor Access:

- PAMM: Investors generally only have access to viewing the overall performance of the pooled account. They may not see the individual trades or how their funds are being allocated at a granular level.

- MAM: Investors can monitor their own account performance individually. Depending on the broker’s platform, they may be able to view specific trade details, including entry and exit points, and have more insight into how their funds are being allocated.

8. Broker’s Role:

- PAMM: The broker generally handles the distribution of profits and losses to each investor’s account based on their share in the pool. The broker manages the technical aspects, like calculating profits and fees, on behalf of the investors and manager.

- MAM: The broker may offer a more advanced platform for managing multiple accounts simultaneously. The broker provides the infrastructure to allocate trades, but the manager has more control over how funds are distributed across accounts.